We work with our partners very closely in order to fully replicate all actuarial calculations carried out by each pension plan’s actuary.

Actuarial Liability Calculations

To create sound Liability-Centric Solutions that explicitly reflect pension liabilities, it is paramount to accurately measure pension liabilities which are the central element around which Liability-Centric Solutions are developed.

To have proper and accurate measurement of pension liability, we fully replicate pension plan actuary’s liability calculations based on two alternative approaches:

We can carry out full actuarial valuations and develop most accurate measurements of liability from basic principles by loading participant census data and appropriate decrements into our valuation systems and by applying standard pension actuarial valuation methodology for calculating pension liabilities.

Alternatively, we can use Liability Cash Flows developed by the pension plan’s actuary in order to calculate pension liabilities, which is acceptable approach for frozen pension plans with Liability Cash Flows not sensitivities to interest rates.

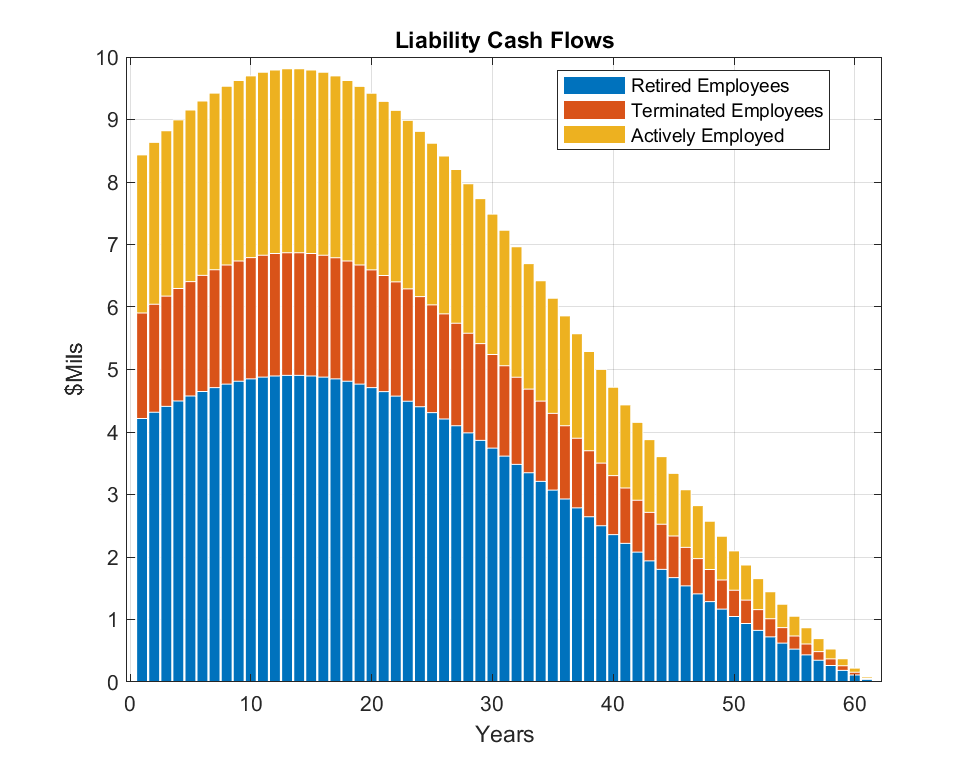

Liability Cash Flows Calculations

Liability Cash Flows represent the most important element for each and every Liability-Centric Solution.

Liability Cash Flows constitute actuarially determined expected payouts from a pension plan.and they represent a major building block for creating all Liability-Centric Solutions. As such, the accuracy of Liability Cash Flows is paramount, since they are used in each and every aspect of building Liability-Centric Solutions:

Liability Cash Flows are integral parts of ALM Studies, since all elements of ALM Studies depend on actuarial liabilities and by extension actuarial Liability Cash Flows.

Customized Liability Hedge Fixed Income Solutions are built around Liability Cash Flows, and they explicitly reflect liability amount, liability’s sensitivity to interest rate, Liability Cash Flows, and any potential Liability Cash Flows’ sensitivity to interest rate.

Liability Cash Flows are crucial for measuring liability’s sensitivities to interest rates, such as Duration, Convexity, Key Rate Durations, and Factor Sensitivities.

Liability Cash Flows are central element for optimizing custom Dynamic Asset Allocation strategies and building appropriate Investment Policies, since all ALM Study-based stochastic optimizations explicitly reflect pension liabilities and Liability Cash Flows as well as appropriate sensitivities to interest rates.

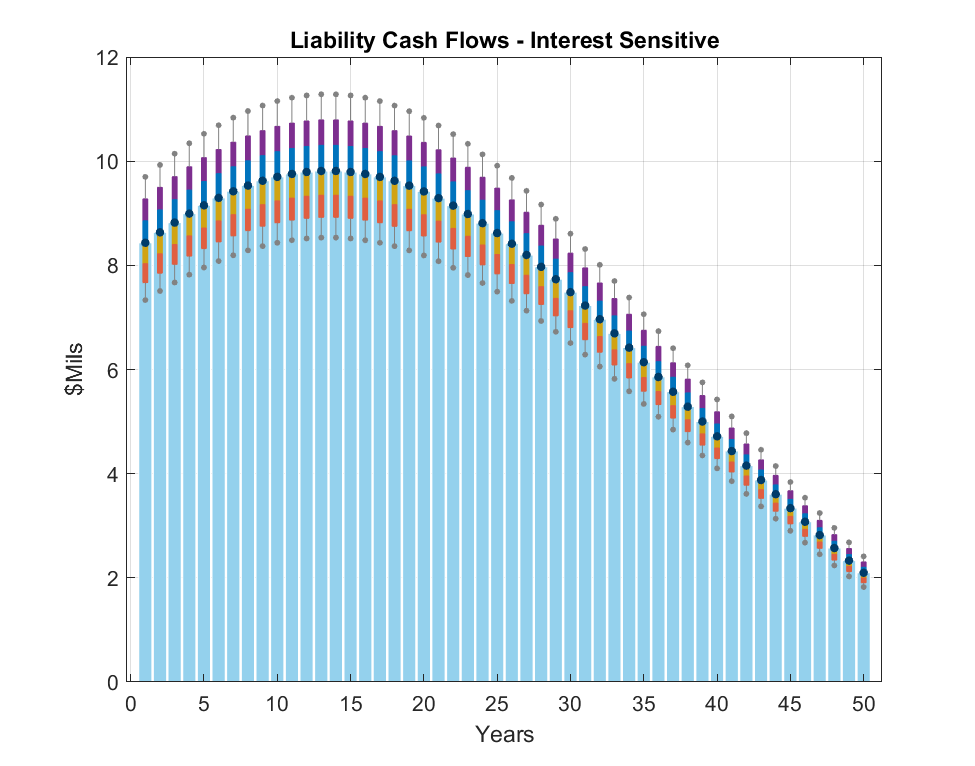

Interest Rate Sensitive Liability Cash Flows

Our Actuarial Valuations and replication of all the results published by pension plan’s actuary will ensure that we have accurate measurements of liabilities and Liability Cash Flows, as well as their respective sensitivities to market interest rates, in order to build effective and sound Liability-Centric Solutions.

Once our Actuarial Valuations are completed, we have strong foundation upon which to build sound Liability-Centric Solutions, unique to each and every pension plan, that explicitly reflect pension plan specific items, such as pension liabilities, Liability Cash Flows, ERISA-PPA funding requirements, FASB disclosure requirements, cash inflows and benefit payment outflows, and multi-period horizon.