We work with our partners very closely in order to incorporate their capital market views for returns, volatilities, and correlations for all asset classes in our ALM Studies. Where needed, we supplement our partners views with our own factor-based Capital Market Assumptions.

Capital Market Assumptions (CMA) are one of the most important inputs to Monte Carlo simulations in order to generate asset returns, yield curve term structures, and credit spreads.

Capital Market Assumptions can be established in one of the following ways:

Static

CMA

- Traditional approach to modeling Capital Market Assumptions.

- Returns, volatilities, and correlations are assumed to be time invariant or fixed over 5-10 year periods.

- More sophisticated version is when different Static CMA can apply to different sub-periods (ex each 5 years).

Dynamic

CMA

- Returns, volatilities, and correlations are assumed to be time variant in each period and change over time.

- Fully regime sensitive and reflective of empirical evidence that returns, volatilities, correlations change over time.

- More complex to model and implement but also more flexible for expressing various capital market views.

Factor Based CMA

- Empirical research shows that returns, yield curves, and credit spreads can be forecasted by certain factors.

- Factor examples include dividend yield, earnings yield, interest rate term structure (especially slope), and others.

- Such factors are typically Dynamic in nature, i.e. time variant, leading to Dynamic Factor-Based CMA.

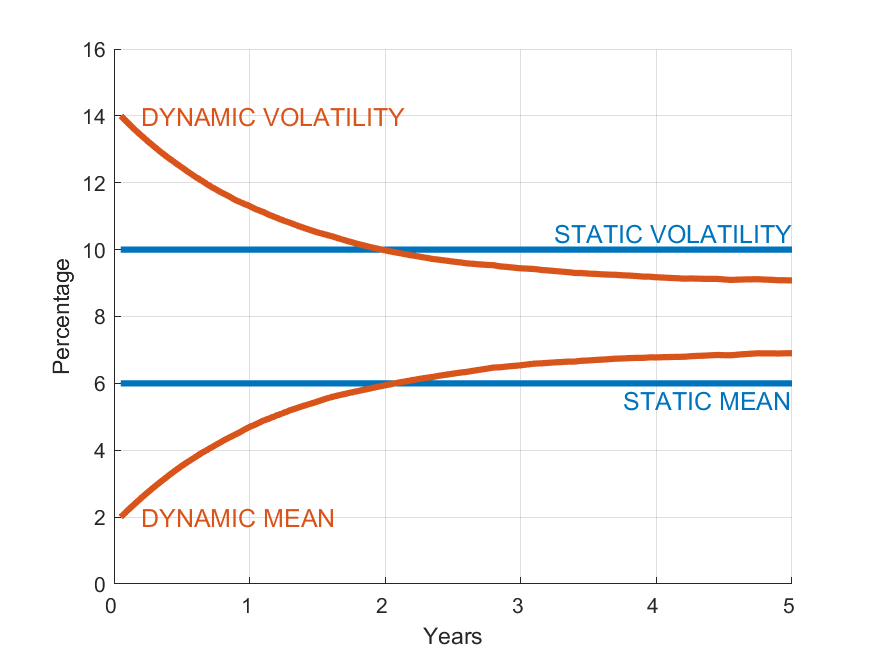

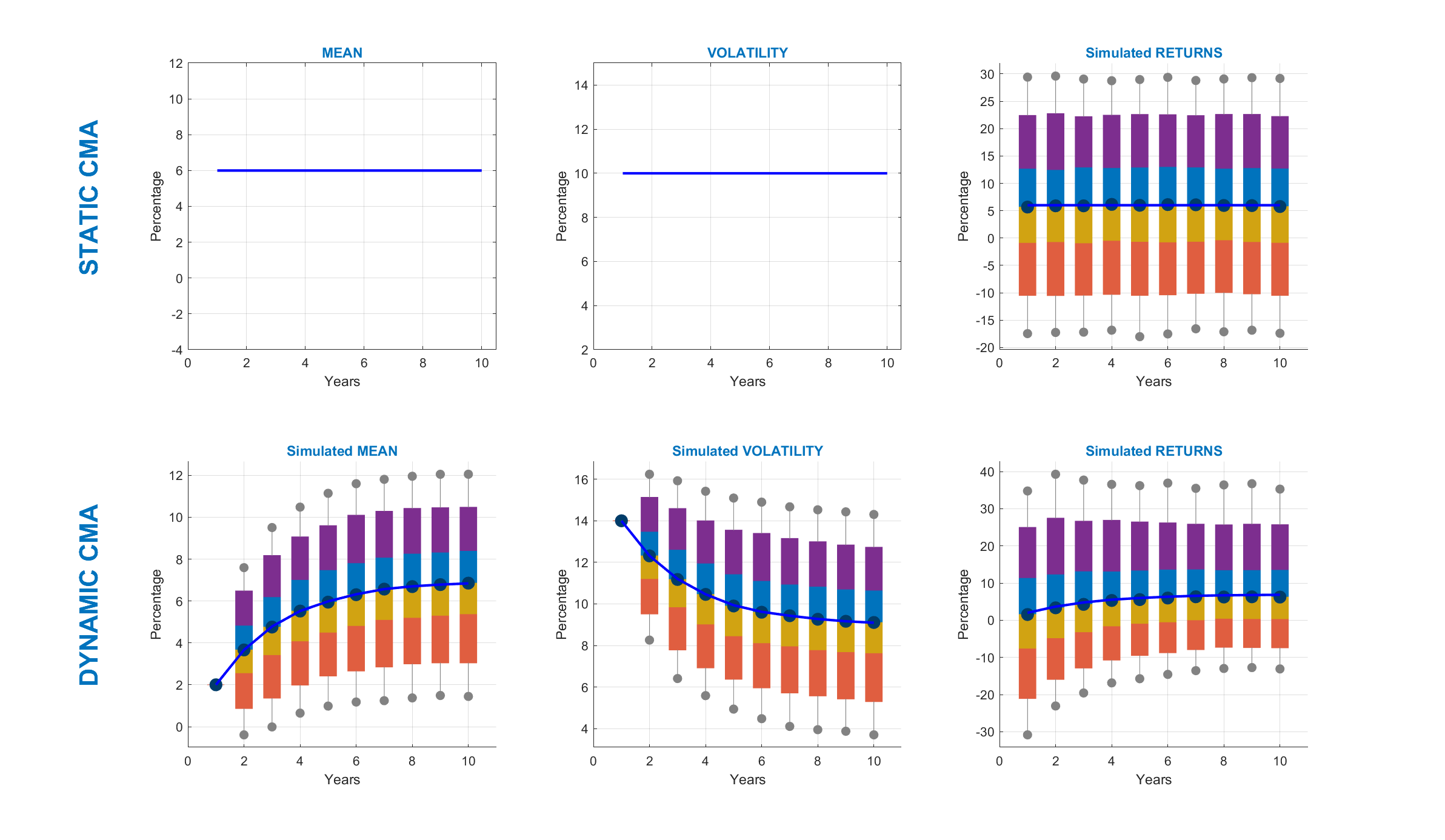

Static vs Dynamic CMA

The following two charts illustrate conceptual differences between Static and Dynamic CMA:

Static Mean and Volatility assumptions are fixed values and do not change over time.

Dynamic Mean and Volatility assumptions are not fixed values and can change over time.

Dynamic Mean and Volatility assumptions are stochastic in nature and can be simulated using typically mean-reverting processes based on:

Long-term target levels for Mean and Volatility.

Speed of mean-reversion for Mean and Volatility.

Volatility assumptions for Mean and Volatility.

Factor-Based CMA

Factor-based CMA are discussed in greater detail here