We create a wide variety of Glidepath Solutions, all fully customized to each and every client, and all fully reflective of the investment processes adopted by our partners.

Glidepath Overview

Once the Liability Hedge Fixed Income Solution is created, the question becomes how much should be allocated to such Liability Hedging portfolio and how much should be allocated to Return Seeking portfolio (equities, etc) for various funding levels and interest rate levels.

Glidepath or Dynamic Asset Allocation is a strategy where total pension assets are reallocated from Return Seeking portfolio to Liability Hedging portfolio when certain triggers are met, such as for example when Funding Ratios and/or Discount Rates increase.

The spectrum of various Glidepath Solutions that we can provide ranges:

The following are some of the examples of Glidepath Solutions that can be customized to each and every client, plus much more.

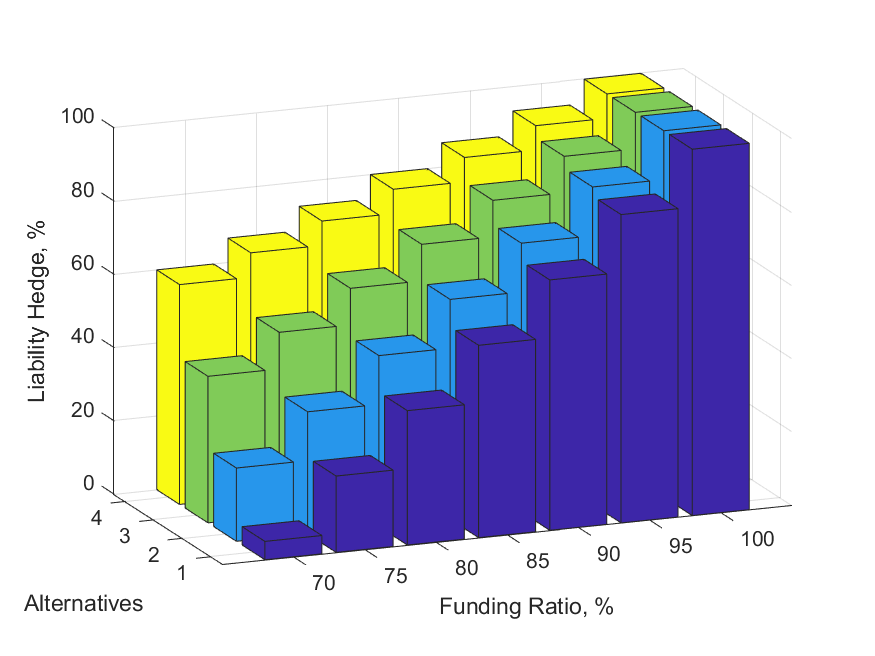

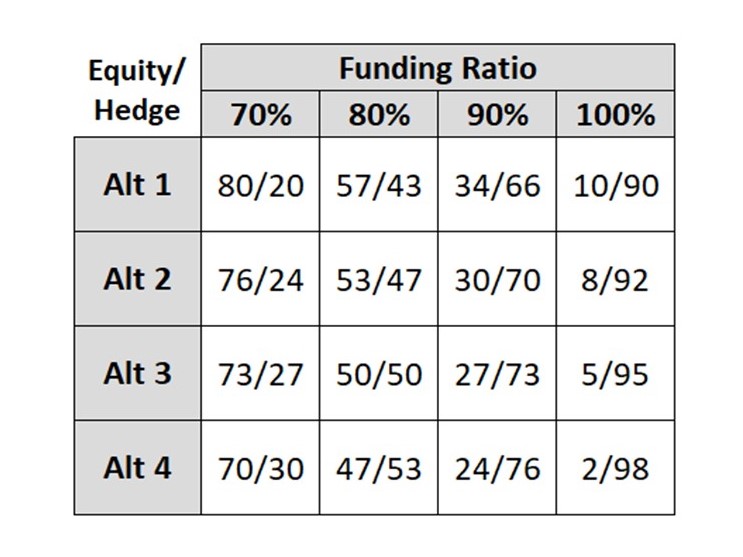

Single-Trigger Linear Glidepath

This is the simplest Glidepath form as a linear proration from Return Seeking assets (equities, etc) to Liability Hedging assets as Funding Ratios increase.

- Provides a good first order approximation for implementing pension plan de-risking.

- Easy to visualize as a linear reallocation of assets from Return Seeking to Liability Hedging.

- Relatively simple and practical to execute as only one Trigger is used (Funding Ratio).

- Loosely related to portfolio optimization since such linear reallocation of assets from Return Seeking to Liability Hedging did not come from any portfolio optimizers.

- No easy way to reoptimize annually or when certain conditions change, since linear reallocation is fairly restrictive.

- Glidepath customization to each client’s objectives is more challenging and more difficult to implement.

- Only a single trigger is used, while other relevant triggers may be available.

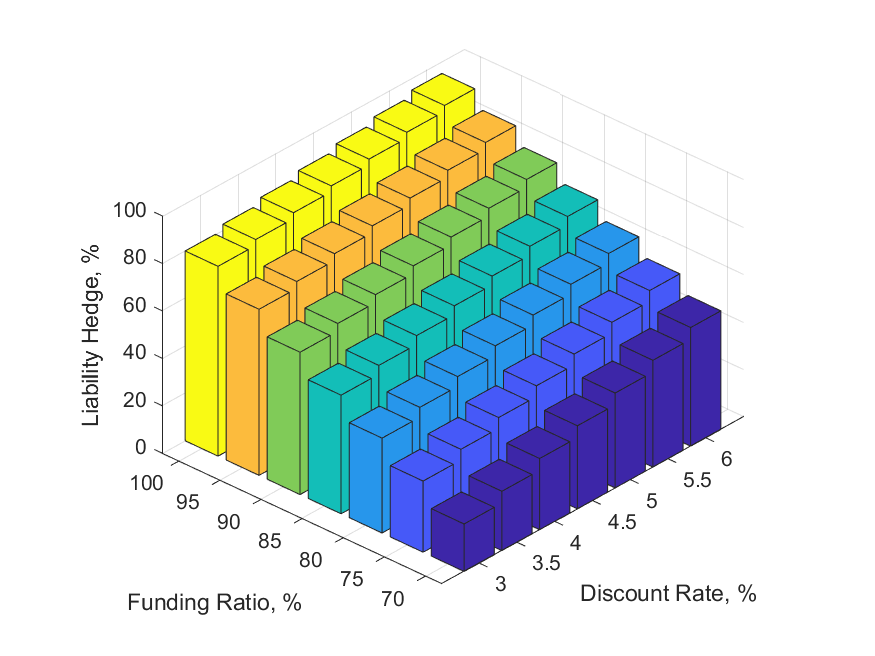

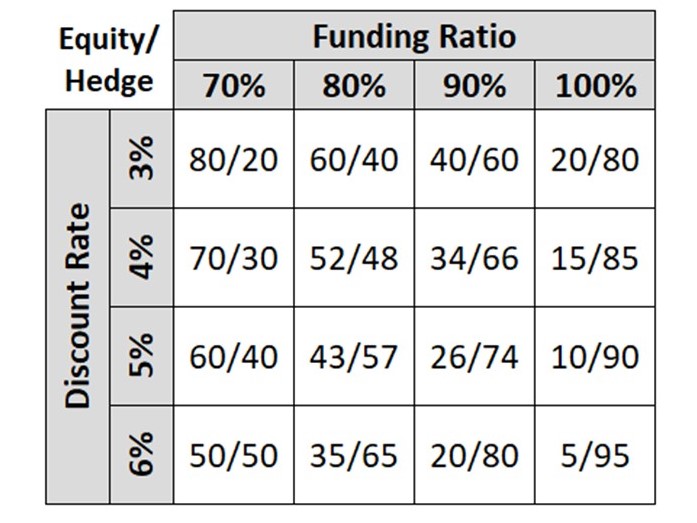

Double-Trigger Linear Glidepath

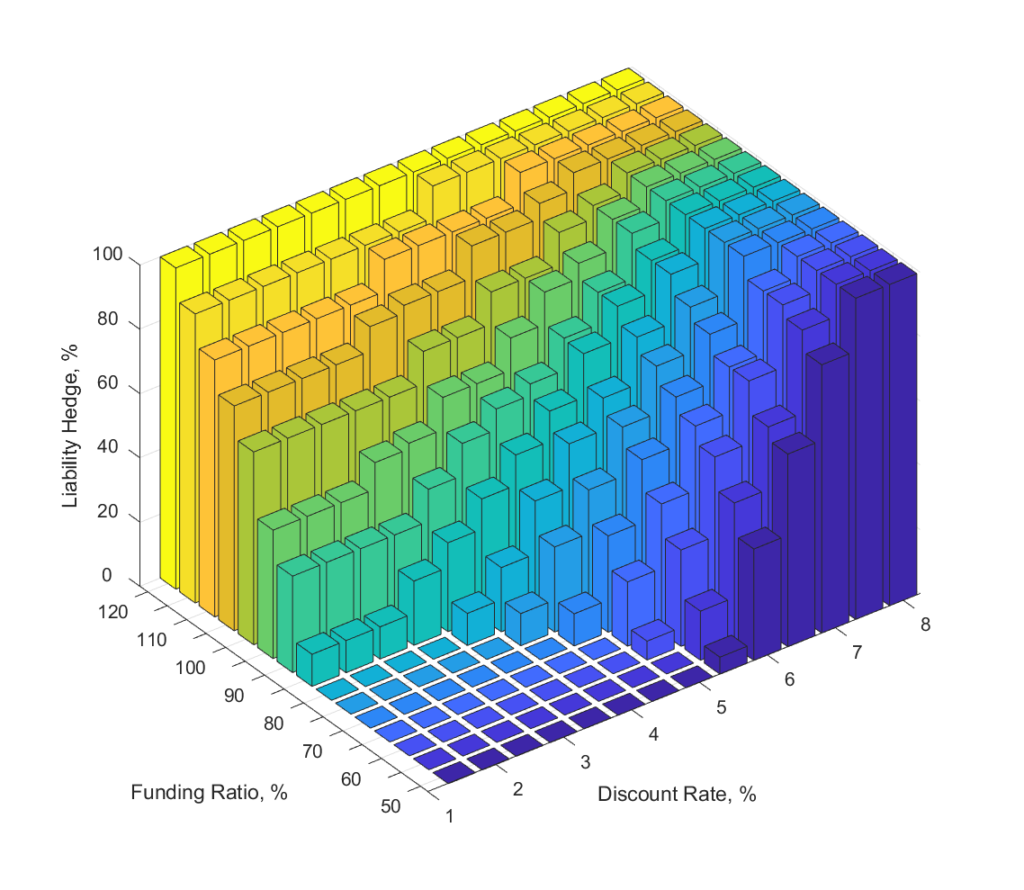

This is a more complex Glidepath form but it is still based on linear proration from Return Seeking assets (equities, etc) to Liability Hedging assets as Funding Ratios and/or Discount Rates increase.

- Provides a good first order approximation for implementing pension plan de-risking.

- Easy to visualize as a linear reallocation of assets from Return Seeking to Liability Hedging.

- Two triggers are used (Funding Ratio and Discount Rate) which will allow for a more optimal outcome.

- Still it is loosely related to portfolio optimization since such linear reallocation of assets from Return Seeking to Liability Hedging did not come from any portfolio optimizers.

- No easy way to reoptimize annually or when certain conditions change, since linear reallocation is fairly restrictive, especially with two triggers.

- Glidepath customization to each client’s objectives is more challenging and more difficult to implement.

Double-Trigger Non-Linear Optimized Glidepath

This is the most complex Glidepath form since reallocation from Return Seeking assets (equities, etc) to Liability Hedging assets is fully optimized as part of a single optimization process.

- Return Seeking and Liability Hedging assets are fully integrated as part of the overall portfolio optimization process.

- Based on well established and well researched stochastic portfolio optimization theory.

- Multiple rebalancing triggers can be used if needed in order to reflect each client’s unique liability profile.

- Fully customized to each and every client’s objectives and constraints.

- This methodology is computationally intensive and requires numerical methods to solve, such as Monte Carlo simulations.

- No closed form solutions are available and numerical methods are usually required.

Glidepath construction based on stochastic portfolio optimization is discussed in greater detail here