We create a wide variety of Liability Hedge Fixed Income Solutions, all fully customized to each and every client, and all fully reflective of the investment processes adopted by our partners.

Spectrum of Liability Hedge Strategies

Pension de-risking concept is based on the notion that pension assets can be invested in a portfolio that will have high correlation with pension liability over time. Such portfolio of assets, called Liability Hedge, is a fixed income solution designed to match liability’s sensitivity to interest rates and therefore be highly correlated with liability, which will minimize asset-liability mismatch risk.

We provide the entire spectrum of Liability Hedge strategies, which can be ranked based on:

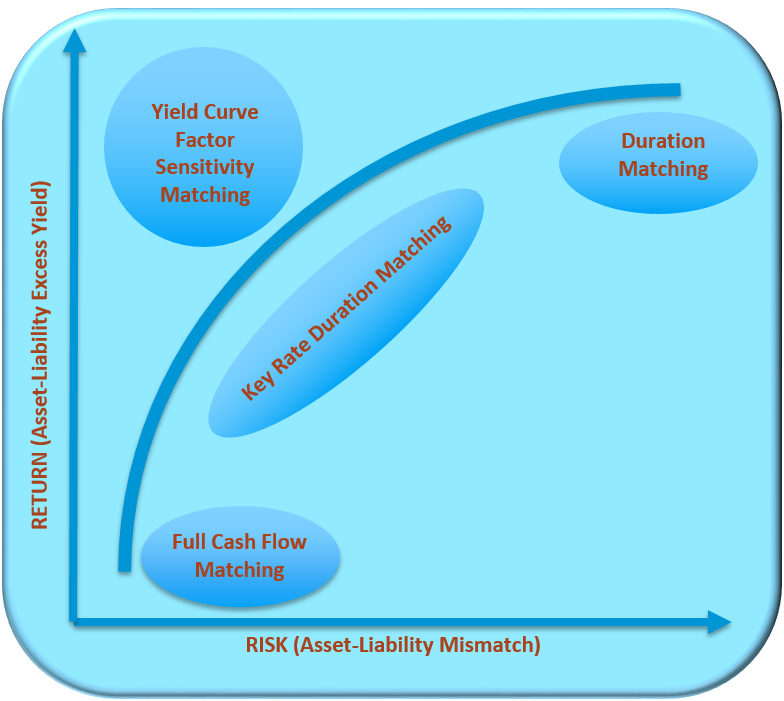

Efficient Frontier type chart can be used to plot various Liability Hedge strategies based on their Risk and Return measures and therefore compare their respective expected performance as follows:

Duration Only Matching strategy has highest Risk-Return, as it is least restrictive strategy.

Duration and Convexity Matching will reduce Risk while providing lower Return.

As Key Rates Matched are added, Risk and Return will continue to be reduced.

Factor Sensitivity Matching strategy is more efficient and effective alternative to strategy with about 10-15 Key Rates matched.

Cash Flow Matching

Full Cash Flow Matching strategy results in lowest Risk and Return, i.e. it is the strategy with lowest asset-liability mismatch and lowest yield potential.

Overview of Liability Hedge Strategies

We provide the following Liability Hedge Fixed Income Solutions, which are always fully customized to each and every client’s portfolio:

Only

Matching

- Duration of Bond portfolio is designed to match Duration of pension liability.

- Duration matching provides greatest yield potential while resulting in greatest Asset-Liability mismatch, since this strategy only hedges against small and parallel changes of term structure.

- Among all strategies, this is the least restrictive strategy.

Convexity

Matching

- In addition to matching Duration of liability, bond portfolios can also match Convexity of liability.

- This strategy requires less frequent rebalancing as compared to Duration only matching, since it can hedge against larger shifts of term structure.

- However, due to lower Asset-Liability mismatch, expected yield is also lower.

Duration

Matching

- Bond portfolio’s sensitivity to changes in certain Key Rates of term structure is matched with pension liability’s sensitivity to changes in such Key Rates to hedge against non-parallel shifts of term structure.

- As Key Rates matched increase, Asset-Liability mismatch decreases, resulting in lower yield.

- Matching all Key Rate Durations is equivalent to matching all Liability Cash Flows.

Sensitivity

Matching

- This is the more advanced strategy designed to hedge against non-parallel shifts of term structure.

- Term structure of interest rates is decomposed into three factors (Level, Slope, and Curvature) using statistical technique know as Principal Component Analysis.

- Bond portfolio sensitivity to changes in factors is matched with liability’s sensitivity to changes in factors.

Cash Flow

Matching

- This is the most restrictive strategy, providing lowest Asset-Liability mismatch and as a result lowest yield.

- Since all Liability Cash Flows are fully matched with expected coupon and principal payments, market value of this bond portfolio will be equal to market value of liability as each future time period.

- This Fully Cash Flow matched bond portfolio can also serves as Liability Based Benchmark.

Factor Sensitivity Matching Liability Hedge Strategies

Liability Hedge Strategies based on Factor Sensitivity Matching are discussed in greater detail here