We create comprehensive Ongoing Monitoring and Rebalancing Reports, which are always fully customized to each and every client’s pension plan.

Reports Overview

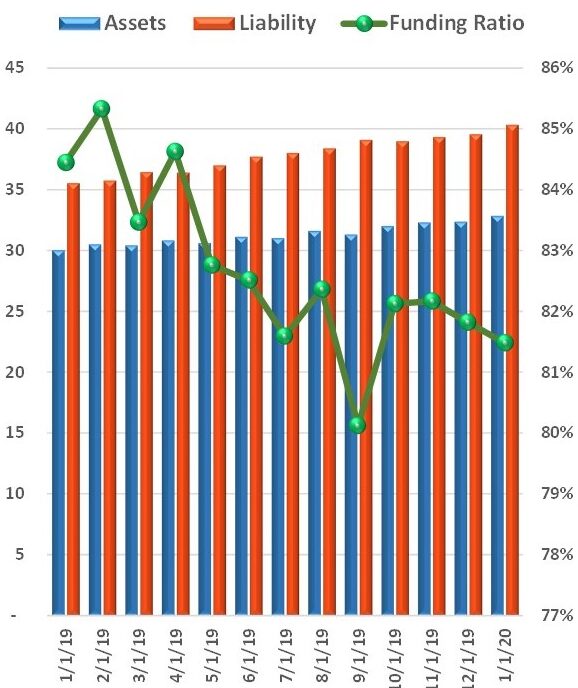

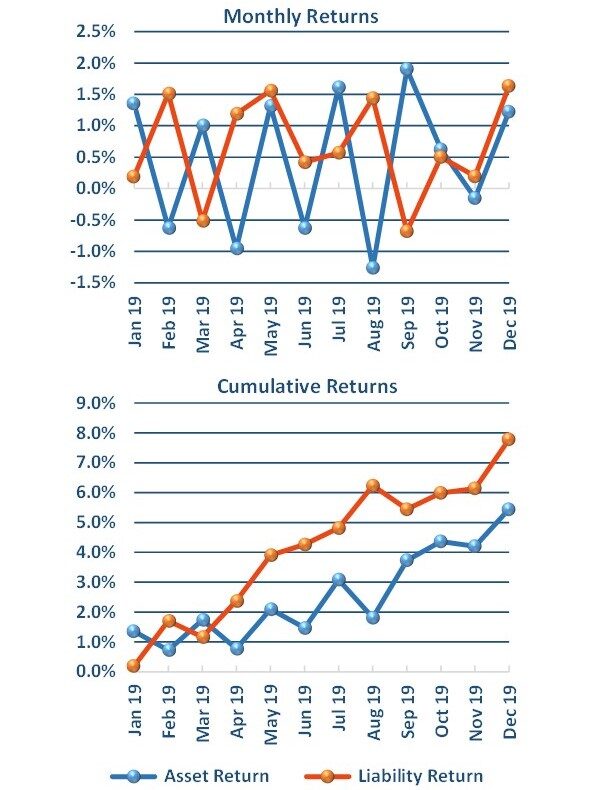

Every solution is only as good as its execution in real time. Therefore, we provide Ongoing Monthly/Quarterly Monitoring and Rebalancing Reports where we recalculate all actuarial liabilities, assets, Funding Ratios, and other items necessary to measure pension plan’s status in real time throughout the year:

Ongoing Monitoring and Rebalancing Reports determine whether Glidepath triggers are reached and, if so, whether portfolio rebalancing is required in order to ensure accurate and timely execution of Investment Strategy as specified by Glidepath.

Reports also provide all liability risk drivers necessary for creating and updating Liability Hedge Fixed Income Solutions, such liability risk drivers as liability’s Duration, Convexity, Key Rate Durations, and yield curve Factor Sensitivities.

We provide such reports monthly, quarterly, or more frequently if needed, while pension plan’s actuaries typically provide this data only once a year. Therefore, our Ongoing Monitoring and Rebalancing Reports allow our partners and clients to stay on top of their pension plans’ status in real time throughout the year.

Charts from the Report

The following are some of the charts included in our Ongoing Monitoring and Rebalancing Reports: