We work with our partners very closely in order to create ALM Studies, which are always fully customized to each and every client’s pension plan, and which are always fully reflective of each and every client’s unique objectives and constraints.

Powerful Tool for Pension Plans

Monte Carlo simulation method is a very powerful approach for modeling assets and liabilities of defined benefit pension plans based on simulated asset returns, yield curve term structures, and credit spreads.

Monte Carlo method is also very useful tool for defined benefit pension plans since it completely reflects all pension plan specific items:

- Liability characteristics.

- ERISA-PPA funding rules and cash inflows.

- Benefit payment outflows.

- Funded Status based restrictions.

- De-risking objectives and constraints.

- Path dependency specific to each pension plan.

- And many other unique objectives and constraints.

Key Elements of Monte Carlo Simulations

The following are the key elements of each and every ALM Study:

Capital Market Assumptions are the most critical input to simulating all asset returns, yield curve term structures, and credit spreads.

Simulated term structures, credit spreads, and Liability Cash Flows are used in order to estimate future pension liabilities.

Simulated asset returns, asset allocations, Glidepaths, and benefit payouts are used in order to estimate future pension assets.

Simulated assets and liabilities are subsequently used to estimate ERISA-PPA cash contribution inflows into pension plan’s portfolios.

Simulated Liability Cash Flows are subsequently used to estimate benefit payment outflows from both assets and liabilities.

Great Analytic Applications

Monte Carlo simulation method offers substantial analytic applications for defined benefit pension plans, as it can be used to:

- Analyze and develop pension contribution policies.

- Optimize de-risking glidepaths.

- Compare various asset allocations to develop investment policies.

- Create advanced Liability Hedge Fixed Income Solutions.

- Analyze impacts of pension plan amendments and lump sum windows.

- Facilitate pension risk transfer transactions.

- Have many other analytic applications.

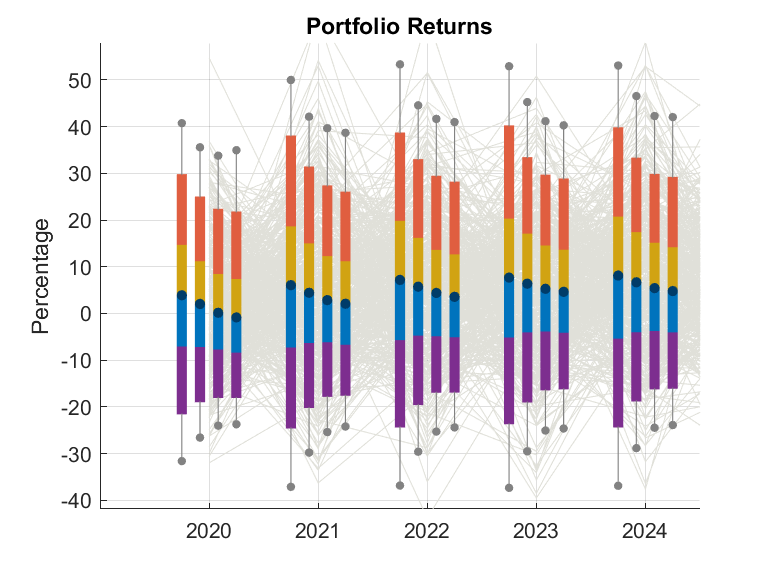

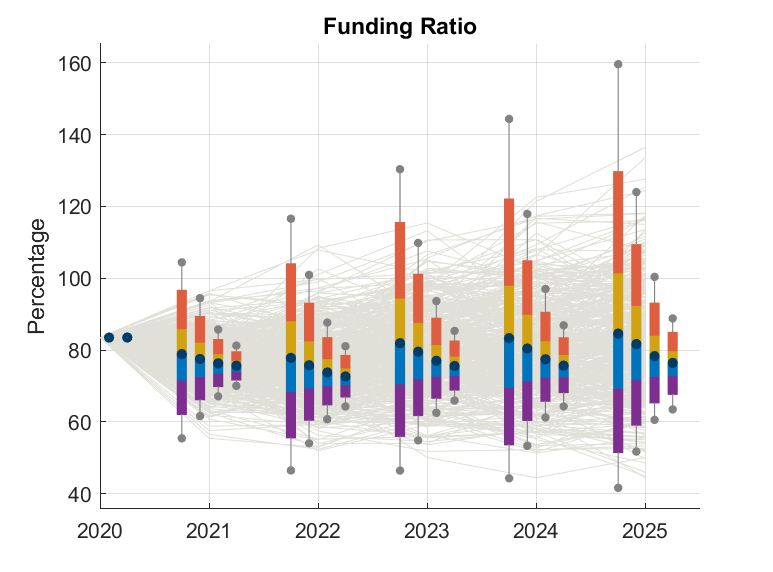

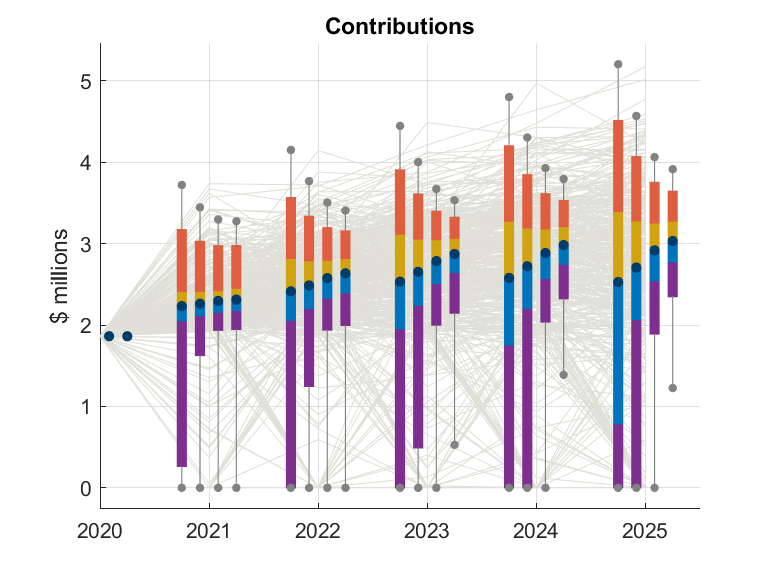

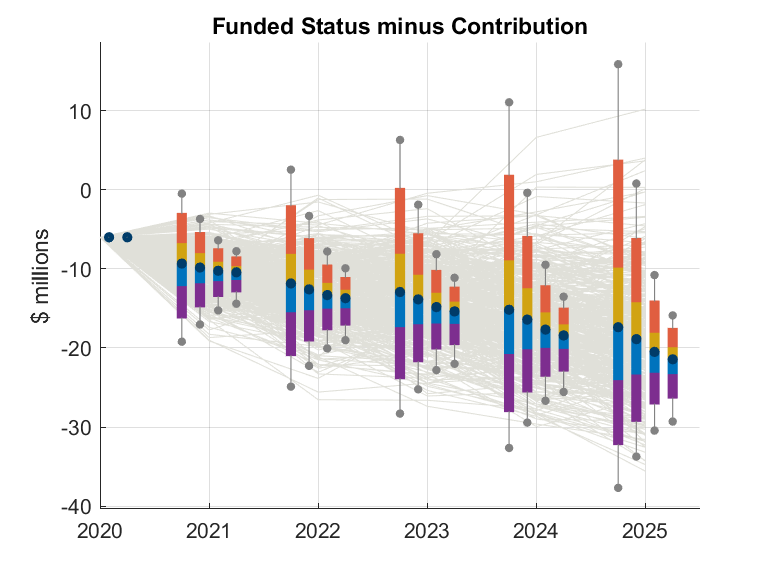

Output Charts from Monte Carlo Simulation

The following charts are based on four different asset allocations (from more aggressive on the left to less aggressive on the right) in order to compare simulated Portfolio Returns, Funding Ratios, Cash Contributions, and Funded Status minus Contributions for a defined benefit pension plan: