Once the Actuarial Valuation is completed, we can carry out both Deterministic and Stochastic projections, based on a variety of different assumptions and/or based on a variety of different Investment Policies.

Deterministic Projections

Deterministic Projections are a very powerful tool with very useful applications for many defined benefit pension plans:

Deterministic Projections are carried out based on a single set of assumptions for a given contribution policy and for a given investment policy. As such, Deterministic Projections are a very powerful “what-if” type analysis based on very specific inputs. Various Deterministic Projections can be carried out for various input values and the results compared to each other.

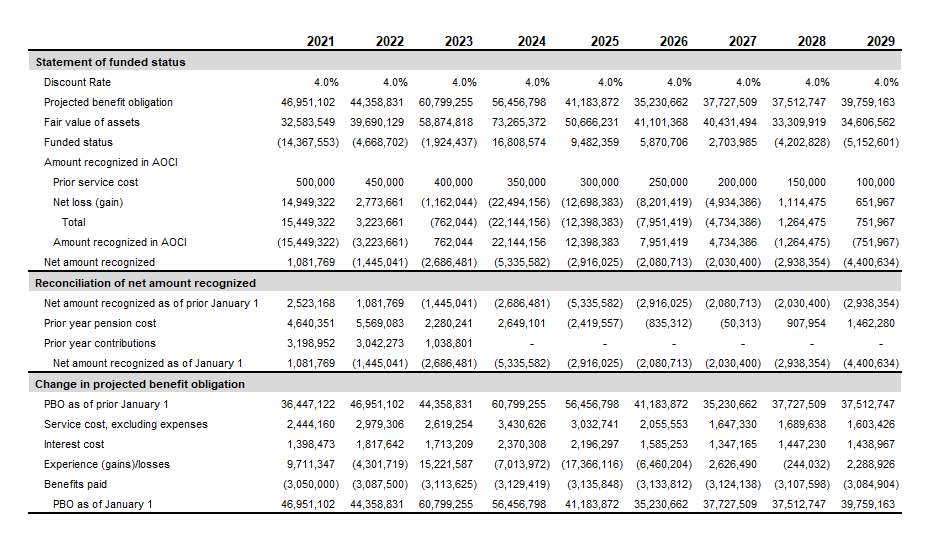

The following table shows an example of Deterministic Projections over the projection horizon for certain elements pursuant to FASB statement ASC 715. Similar Deterministic Projections can be carried out for a great variety of other variables determined based on the requirements of ERISA, Pension Protection Act, ASC 715, and others.

Stochastic Projections

Stochastic Projections, also known as Monte Carlo Simulations, are a very powerful tool with very useful applications for most defined benefit pension plans:

We provide the entire range of analytics related to Monte Carlo Simulations as part of our Comprehensive ALM Solutions and Optimized ALM Solutions, all of which based on such Stochastic Projections.

All ALM Solutions can be very effectively integrated into the annual Actuarial Valuation process and therefore be updated very efficiently and timely when Actuarial Valuations are completed.

Stochastic Simulations can also be very effectively used in order to extract more information from the results of annual Actuarial Valuation reports which tend to be complicated and difficult to analyze.

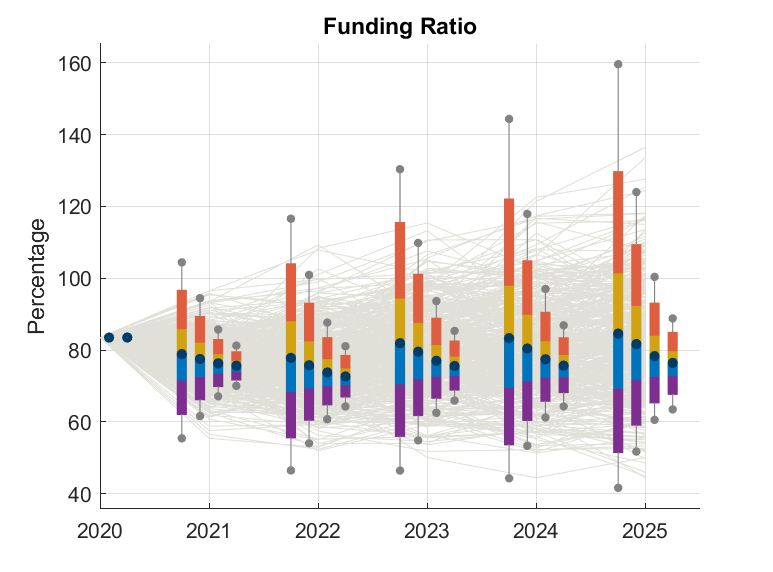

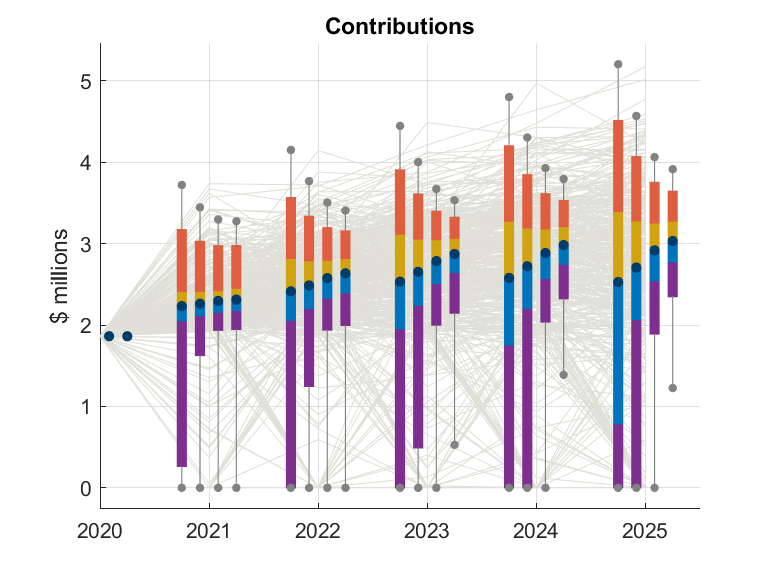

The following charts illustrate some of the examples of how Stochastic Projections can be used in order to model ASC 715 Funding Ratios and PPA Section 436 Cash Contribution requirements.

Stochastic Simulations are discussed in greater details here.