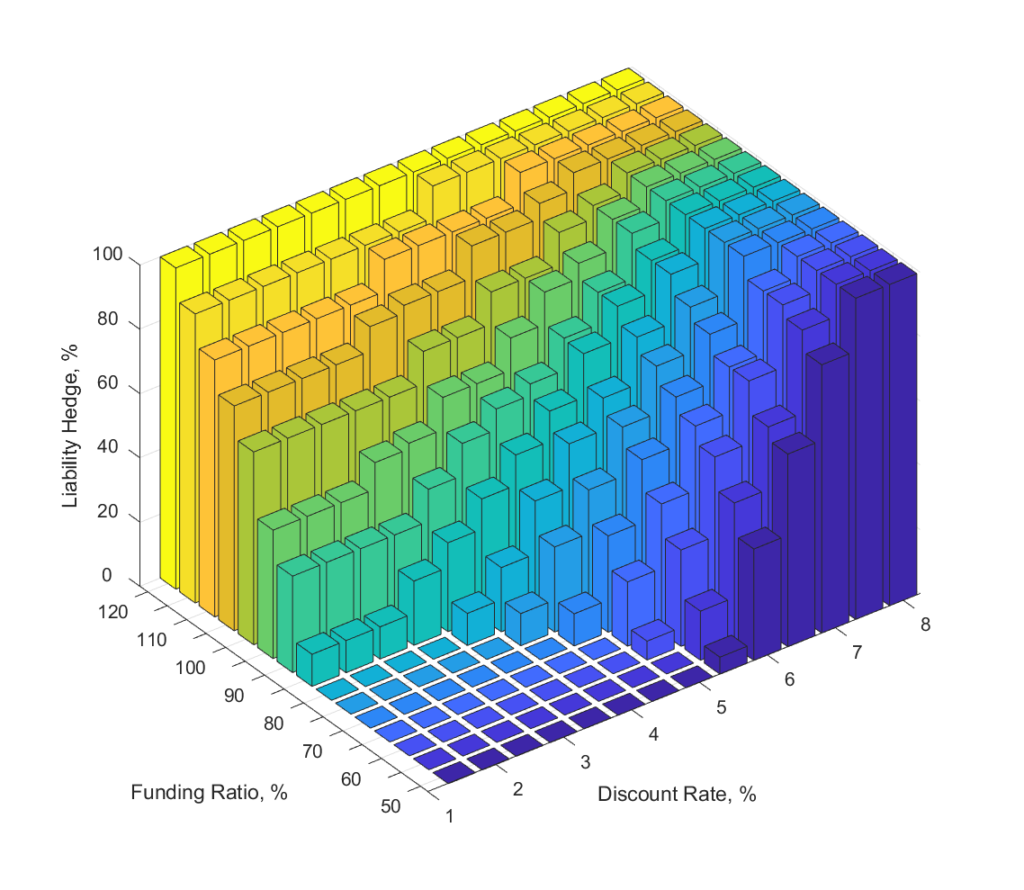

Optimized Glidepath: Direct Result of Stochastic Optimization

Optimized multi-trigger Glidepath is the direct result of stochastic portfolio optimizations solved via Dynamic programming methods:

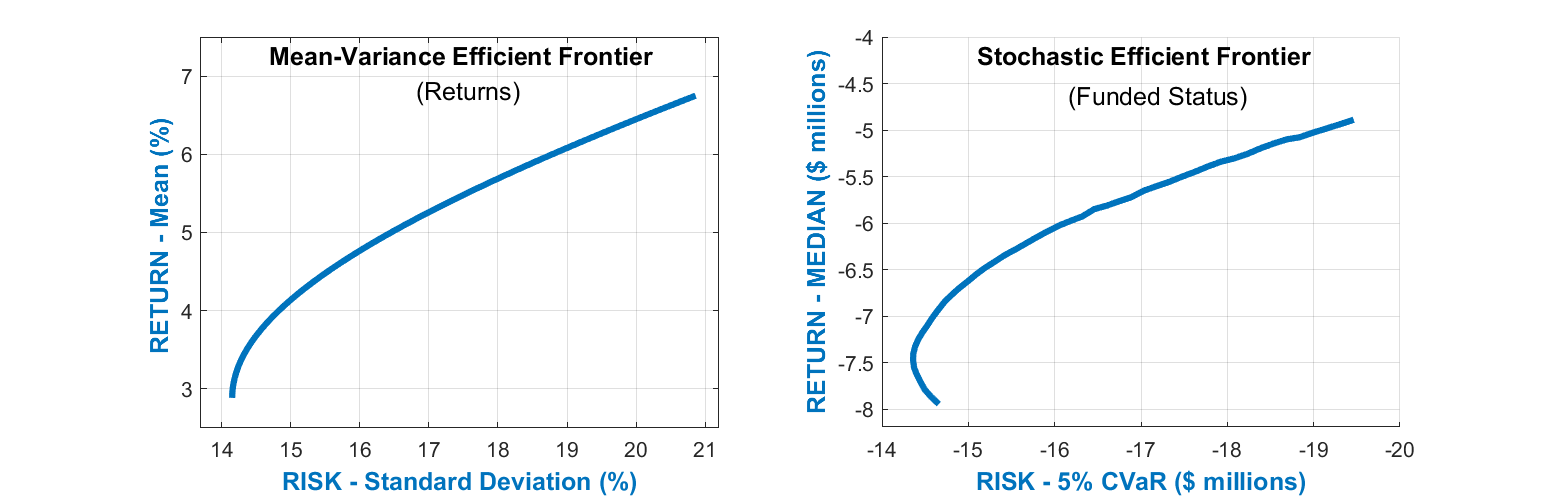

Stochastic Efficient Frontier

Stochastic Efficient Frontier is a very effective way to analyze simulated results of ALM Studies in order to compare impacts of various investment strategies. Just like Traditional Efficient Frontier, Stochastic Efficient Frontier depicts investment strategies based on their respective Risk and Return levels. However, Traditional and Stochastic Efficient Frontiers define Risk and Return differently as shown in the following table:

Risk Measure

Standard Deviation of asset returns

Downside level of Funded Status

Return Measure

Expectation of asset returns

Median level of Funded Status

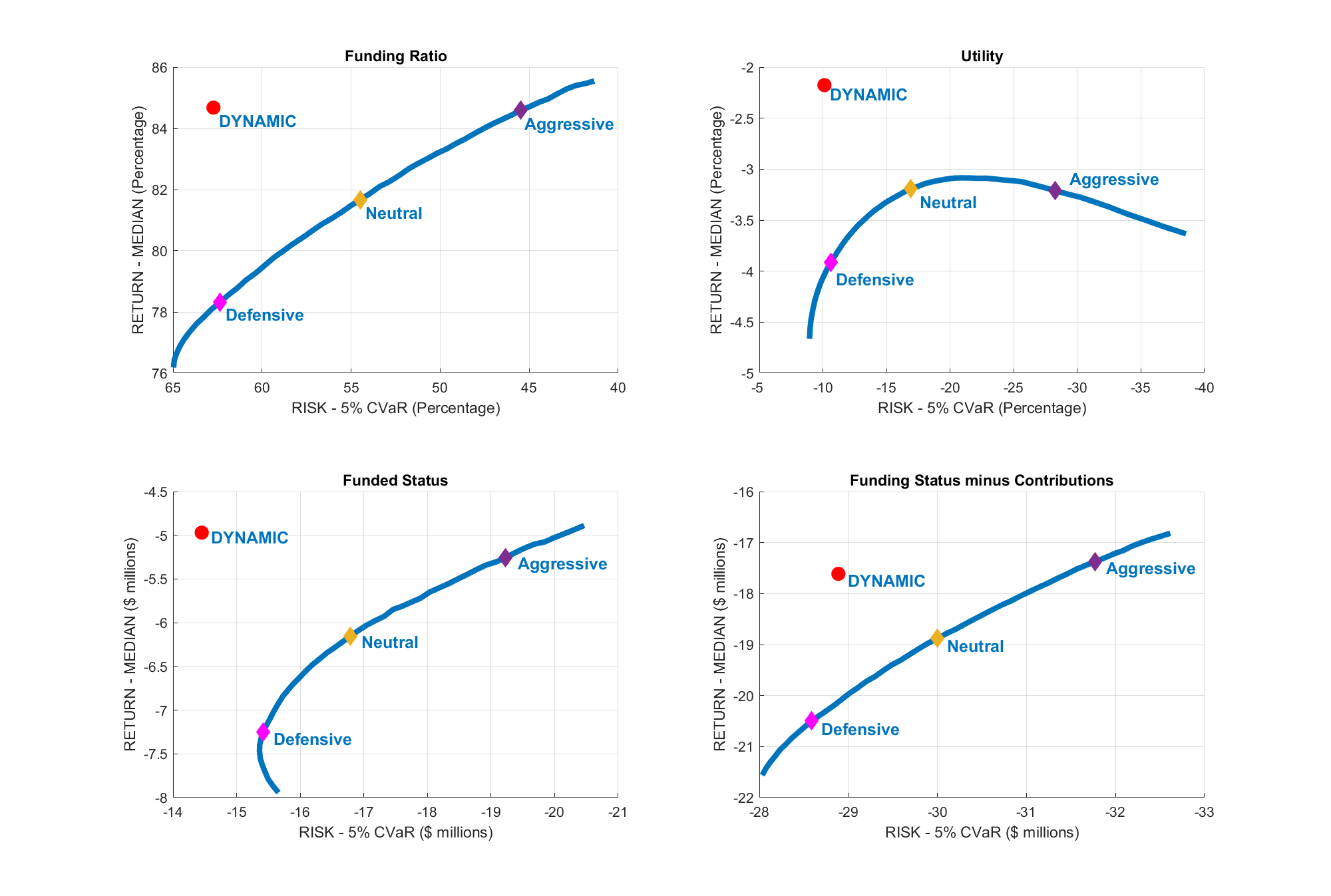

Dynamic vs Static: Stochastic Efficient Frontier

Stochastic Efficient Frontiers are used in order to compare Dynamic Asset Allocation Strategy and Strategies which are Static in nature, based on four different metrics: Funding Ratio, Funded Status, Utility Function, and Funded Status reduced by Accumulated Contributions:

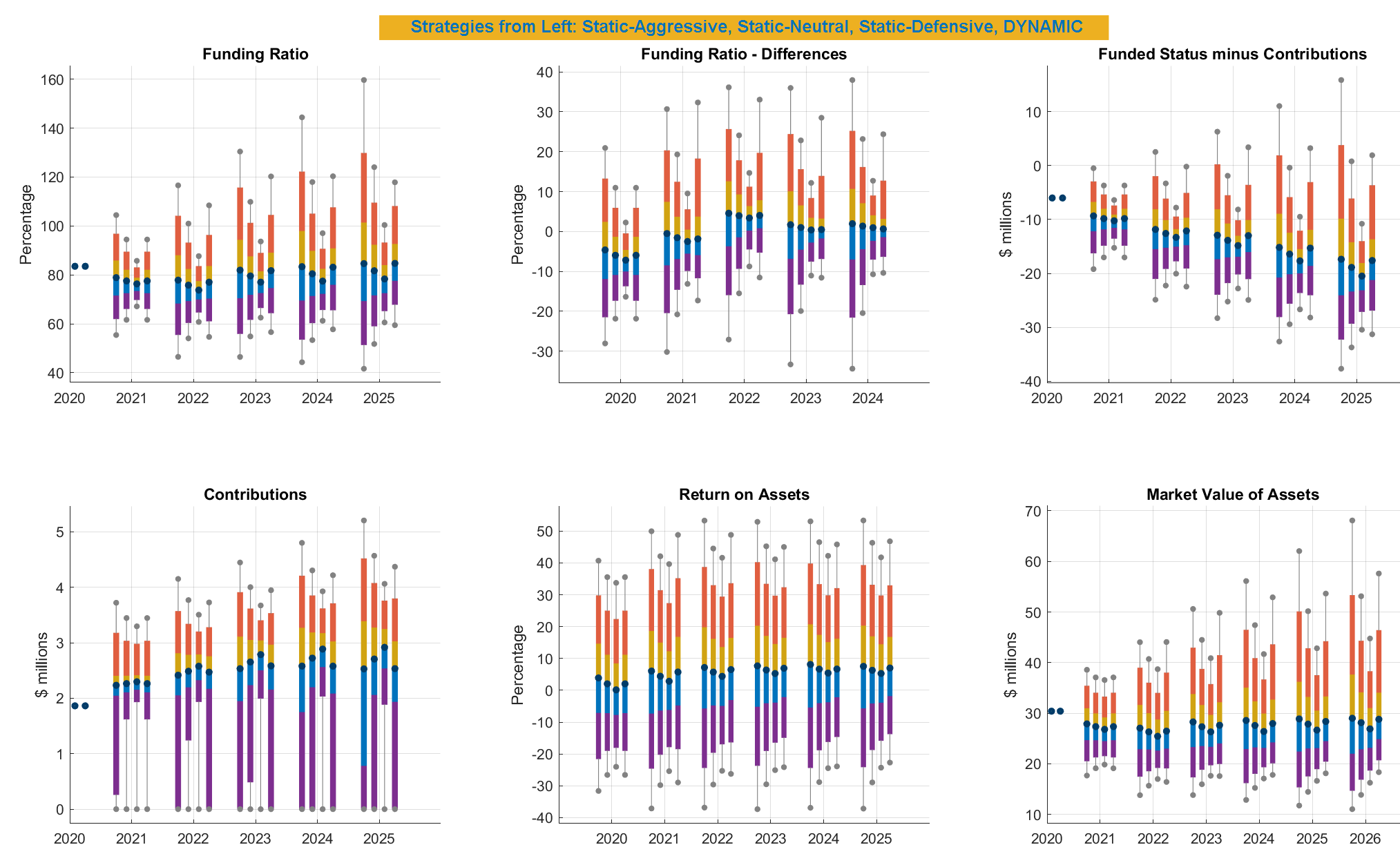

Dynamic vs Static: Simulations

Performance of Dynamic Strategies can also be compared to performance of Static strategies by utilizing stochastic simulation charts: