Traditional ALM Studies for defined benefit pension plans represent multi-period stochastic simulations of Assets and Liabilities, where Investment Policy is typically one of many inputs. ALM Studies can also be run for several different Investment Policies and simulated ALM results can be used to compare these alternative asset allocations.

As such, a natural extension of traditional ALM Studies is to run them for numerous Investment Policies in order to choose one asset allocation that offers the best result and the most optimal outcome.

Therefore, ALM Studies can be used as part of numerical methods for solving complex and custom multi-period stochastic optimization investment problems for pension plans.

Portfolios Optimization: Stochastic vs Mean-Variance

Stochastic portfolio optimization is fundamentally different from traditional Mean-Variance type portfolio optimization as shown in the following table where a number of portfolio characteristics are compared:

Periods

Single-period optimization

Multi-period optimization

Risk Measure

Standard Deviation of asset returns

Downside level of Funded Status

Return Measure

Expectation of asset returns

Median level of Funded Status

Objective Function

Max Return for given Risk or Min Risk for given Return

Max Utility function, such as max Power Utility of Funded Status in 10 years

Generic or Plan Specific

Generic based on asset returns only

Pension plan specific

Pension Liability

Pension liability not reflected

Pension liability fully reflected

Inflows/Outflows

No Inflows/Outflows reflected

All Inflows/Outflows reflected

Customization

Limited customization available

Full customization available

Closed Form Solution

Closed form solution available

No closed form solution, numeric only

Computational Intensity

Low computational intensity

High computational intensity

Complexity

Low complexity

High complexity

Path Dependency

No path dependency reflected

Full path dependency reflected

ALM Study as Numerical Method for Stochastic Optimization

Stochastic portfolio optimization is very powerful and most relevant tool for pension plans since it completely reflects all pension plan specific liabilities, ERISA-PPA funding rules and cash inflows, benefit payment outflows, Funded Status and restrictions, plan specific de-risking goals, and many other custom objectives:

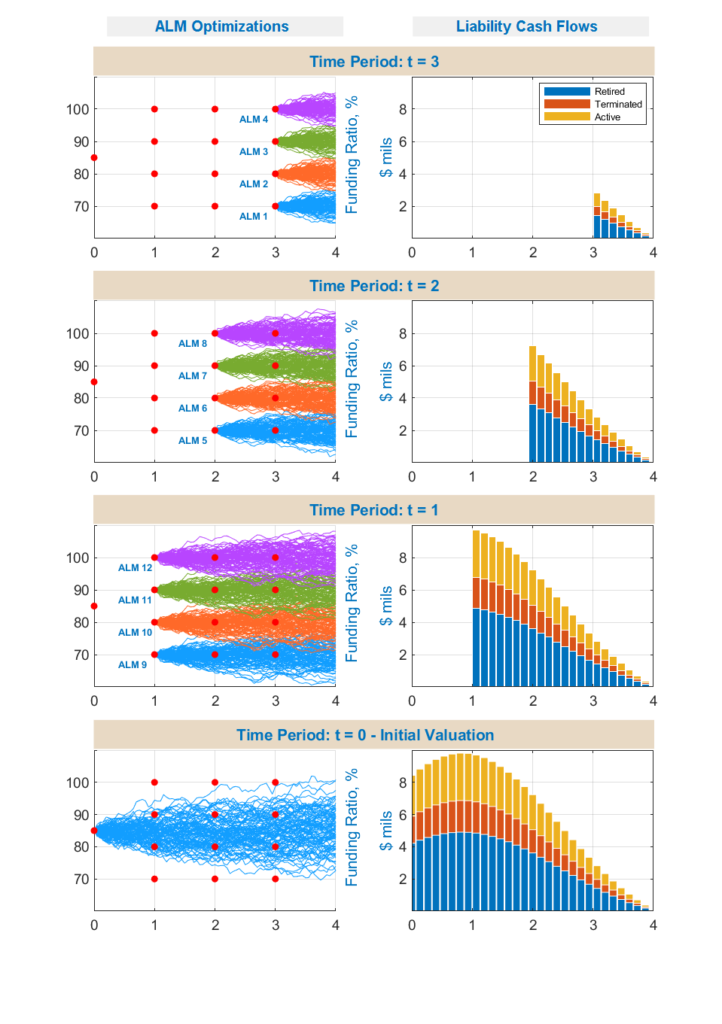

One such methodology is Backward Induction based Dynamic Optimization approach, which is used to solve recursive Bellman Equations based on the following conceptual steps as shown in the following chart:

We start at the beginning of the last period and run ALM Studies over the remaining one period for each level of Funding Ratios and Discount Rates from a grid, and for each ALM run find optimal allocation in the last period, by maximizing chosen expected Utility function (based on end Funded Status and all cash paid).

Then we move one step backward in time to beginning of the second to last period and run ALM Studies over the remaining two periods for each level of Funding Ratios and Discount Rates from a grid, and for each ALM run find optimal allocation in the second to last period, by maximizing chosen expected Utility function (based on end Funded Status and all cash paid), and by using optimal allocations in last period determined in prior step.

This process is repeated for each period moving backward in time until we reach valuation time zero.

The output of this process is Dynamic Asset Allocation, which represents optimal asset allocation at time zero as well as optimal asset allocations for each level of Funding Ratios and Discount Rates found in the grid for each future period used in the portfolio optimization.