Actuarial Valuation results as well as Deterministic and Stochastic Projections can serve as effective tools in order to create Pension Risk Transfer (PRT) Analytics for defined benefit pension plans, including the following key items:

Actuarial PRT Analytics

We provide the entire range of Actuarial PRT Analytics that can be very useful for any PRT transaction:

Data Readiness is a very important part of any PRT transaction and we can create data analytics in order to prepare data for such transactions.

Use Stochastic and Deterministic Projections in order to analyze impact of PRT transaction on future assets/liabilities and choose optimal time of the transaction, optimal liability segment to be transferred, and optimal asset portfolio to be transitioned.

Carry out PRT-specific Experience Studies in order to estimate future Demographic experience for the group of pension plan participants that is expected to be part of PRT transaction.

Determine PRT-specific liabilities, based on appropriate settlement-type Demographic and Economic assumptions for the group of pension plan participants that is expected to be part of PRT transaction.

Advanced PRT Analytics

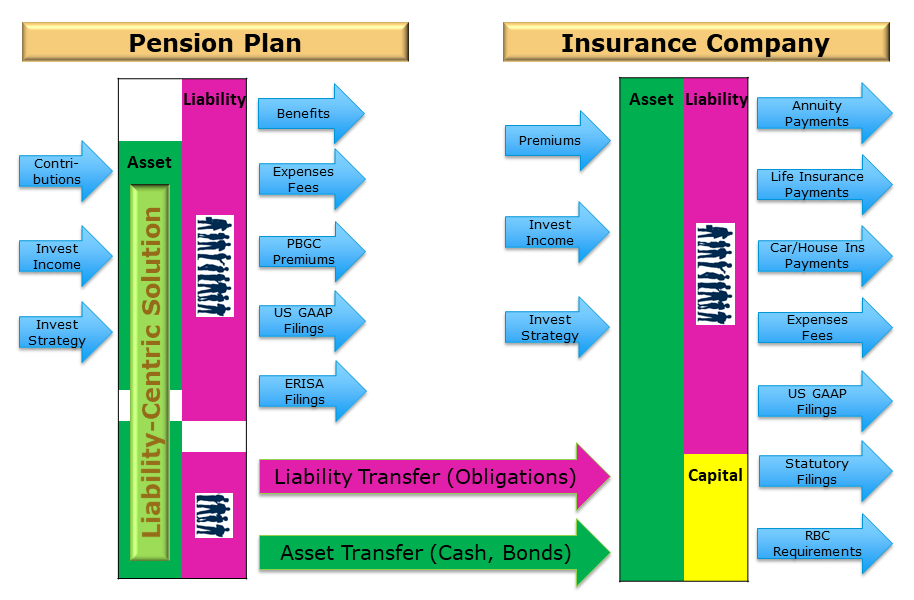

We create Advanced PRT Analytics in order to build optimal Liability-Centric Solutions, fully integrated with PRT transactions, and explicitly optimized with PRT goals as the “end game”:

PRT liability segment, timing of the transaction, current asset allocation, asset pool to be transferred, and other elements of PRT transaction, can be optimized with Investment Policy as part of a single optimization process. In this case PRT and Investment Policy will be cross-optimized.

PRT objective can be incorporate into the overall pension De-Risking framework such that PRT, Glidepath Solutions, and Liability Hedge Fixed Income Solutions are cross-optimized in the first place as part of a single optimization process based on the final PRT “end game” objective.

Following chart illustrates that Liability-Centric Solution can be central component to help pension plan prepare for PRT transaction over perhaps years-long time, then optimize PRT transaction timing, assets, and liabilities, and then seamlessly transition pension from “Before PRT” status to “After PRT” status.